And just like that, 2017 is almost over! Most of us are focused on last-minute gift shopping, parties, and traveling home to see family right now. But in the midst of the craziness, don’t forget some of the financial goals you set for yourself at the beginning of the year.

Did you accomplish everything you set out to do with your finances? If not then there’s still time.

But with just a few days left in the year, it’s hard to know what you should focus on. Here’s a year-end checklist to help you focus on some of the more important items before the start of 2018.

Let’s roll up our sleeves and prepare to end 2017 right!

Ramp up your retirement savings.

Some account types, like IRAs and Roth IRAs, allow you to wait until April 15th of the following year to make a contribution. Other account types, like 401(k) or 403(b) plans can only be funded by payroll deferrals (the rules are slightly different for solo 401(k) plans), and those deferrals have to happen before the end of the calendar year. Find out if you’re on pace to max out your 401(k) plan at work and increase your deferral amounts if needed to get there.

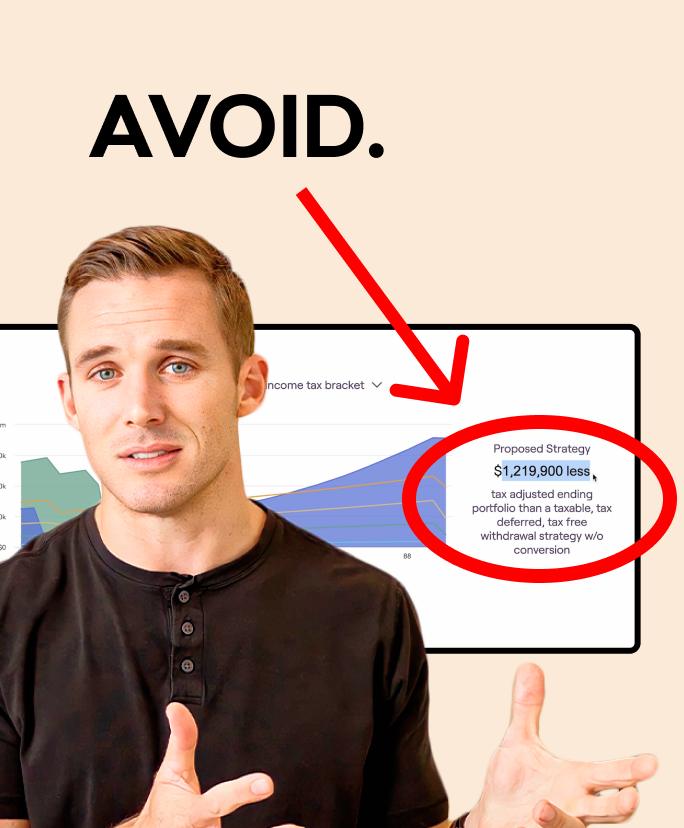

Consider a Roth Conversion

Was 2017 a low-income year for you? Do you have an IRA? It may be a good time to consider converting your IRA to your Roth IRA.

Any amount of your IRA that you convert to your Roth IRA is considered income. That’s why it could be beneficial to convert in a year when you’re not going to be in a high tax bracket. Be careful though – unlike IRA or Roth IRA contributions, a Roth conversion will only count towards the calendar year in which the conversion is completed. Be sure to consult with your financial planner or tax professional before doing this.

Plan Ahead For One Time Expenses

You were so good about sticking to your budget this year, but then that vacation you took and those Christmas presents you bought ruined everything. Well, maybe not everything, but they certainly derailed your savings plan.

To avoid that next year take a look back at all non-monthly expenses for 2017. Then divide that number by 12, and that’s the number that you need to include in your budget for 2018. To really do it right, open up separate savings accounts for some of the larger non-monthly expenses (i.e. vacation or Christmas gifts). Deposit a small amount into those accounts each month so that over the course of the year you can pay for that family vacation without coming home with a difficult credit card bill.

Get Serious About Debt Paydown

If you’re looking back at 2017 and wondering why you weren’t able to accomplish as much financially as you wanted, chances are good it’s because of debt. Nothing can slow down progress towards your goals like debt can. Make this the year that you get serious about eliminating your debt once and for all.

Take advantage of tax deductions!

- Give a tax-deductible charitable contribution. This doesn’t just have to be a cash donation either. Consider donating nice clothes or household goods that you don’t use anymore to Goodwill. This is an excellent way to declutter your house while getting a tax write off at the same time.

- Contribute to your HSA account. Want to protect against health care costs and save taxes? This account is great for both. In 2017 you can contribute up to $3,400 if you’re single and up to $6,750 for a family plan (+$1,000 on each limit if you’re over 55).

- Harvest any losses in your non-retirement accounts. If you have any stocks, ETFs, or mutual funds that have gone down in value this year then you could use this to your advantage on your tax return. Tax loss harvesting involves selling one investment and then using the proceeds to purchase a similar but non-identical investment. In doing this you may be able to maintain the overall risk and return characteristics of your portfolio while using the losses to decrease your tax bill.

Whether 2017 was an amazing year for you, or whether you can’t wait for the fresh start that 2018 is going to bring, it always helps to have a clear plan moving forward.

I’d like to know what your plans are for 2018 and how I can help get you there. Get in touch today so that we can make 2018 your best year yet!