For most people, wealth will not come from their careers. Not all of us will earn six or seven figures per year. But you don’t need a large salary to create wealth. By doing the following 5 things wealthy people do with their money, you can find financial success and achieve real wealth too.

#1: They Set and Stick to Goals

Wealthy people write down their goals. Research has shown that you are 42% more likely to achieve your goals when you write them down.

While it’s true that simply writing down your goals won’t make you magically achieve them, it does rewire your thinking. It helps you consider the things you’re doing that will help or hurt you in achieving your goals.

If you want to advance your career, you’ll stop to consider what you need to do to get a promotion, to move to a better company, or to start your own business. If your goal is to retire at 60 with X dollars, you’ll ask yourself if you’re making the best spending decisions, and if you’re saving and investing enough to reach that goal. If you want to spend $7,000 a month during retirement, you can work backward from that number to know if you’re on track to reach that goal.

By writing down your goals, you can take little actions to ensure you’re constantly moving towards your goal over the weeks and months of your life.

Writing down your goals doesn’t just apply to financial goals; it’s very beneficial for any goals you may have.

#2: They Think Long Term

Reaching goals takes long-term dedication, time, and discipline. When it comes to investing, we have a powerful force working for us, compound interest. But in order for compound interest to work its magic, it needs time.

Let’s say we invest $10,000 today and let it grow for one year with a 10% return. One year seems like a long time. After that year, we would have $11,000. That’s a nice profit, but it’s not going to make us wealthy.

But if we let that money grow for 40 years with a 10% return, we would have more than $452,000. That’s the power of compound interest and long-term thinking.

The problem is we live day to day, week to week, and we have short-term thinking. But investing successfully is a long-term proposition. The wealthy think long-term; what they do today can lead to big results decades in the future. They don’t obsess over their investments daily; they trust the process.

#3: They Own Equity

Real wealth doesn’t come from your hourly wage or salary; it comes from ownership. We only have so many hours in the day, and they can’t all be spent working. We need passive income, a source of income that makes us money even while we sleep.

People often think of owning rental properties or a business when they think of ownership. But many of us don’t want to become landlords or bosses, both of which come with a lot of responsibility.

Owning equity is the ultimate form of passive income, and it’s never been easier or more accessible. Owning equity means owning stock, buying equity in a company.

Let’s use stock in Home Depot as an example. As a stock owner, you’re profiting when everyone is at Home Depot on the weekends buying lumber, paint, plants, and anything else the stores sell. Stocks generate income with no input or work from us.

#4: They Surround Themselves with People Smarter Than Them

People often think that the wealthy must be the smartest people in the room; they know everything. But that isn’t the case. Rather than trying to master everything, wealthy people focus on a few things that they excel at and enjoy. They hire professionals to handle the things they’re not good at or don’t enjoy.

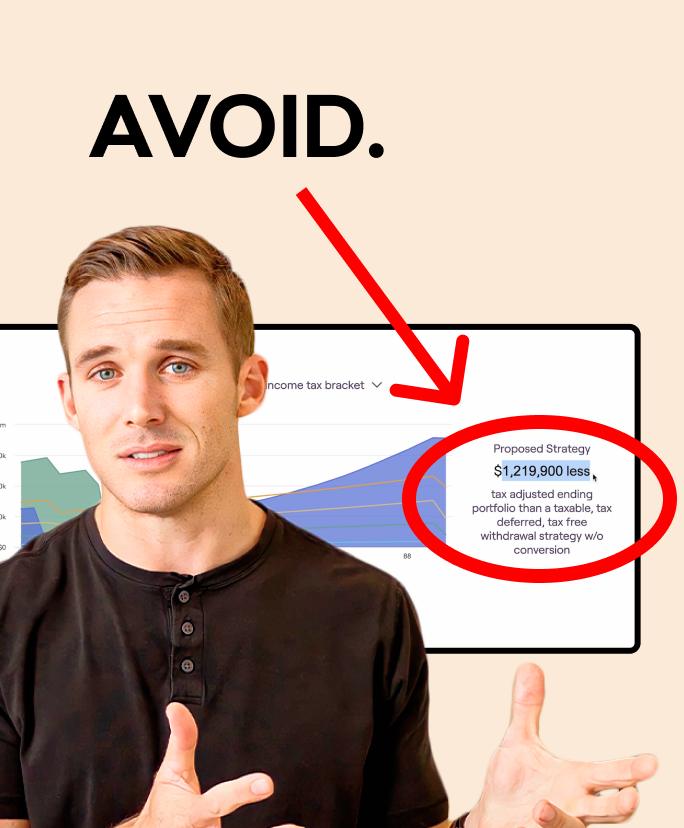

That’s why the wealthy hire professionals like CPAs, tax attorneys, and financial planners. Those professionals can do a better job and free up the wealthy to do what they’re good at and enjoy.

#5: They Don’t React

This may be the hardest thing to do on our list. When the wealthy are surrounded by dire economic headlines, the market is tanking, and everyone is yelling, “GET OUT NOW!” they don’t react. Because it’s not a bad economy or a bear market that does the most damage to our portfolios, it’s us.

If you invested $1,000 in the Russell 3000, which is the top 3,000 US stocks, on January 1, 1997, and left it to grow until December 31, 2021, it would be worth $10,300. That’s a lot of growth over those 25 years. And there were a lot of bad days, weeks, and months for the market over that span.

If you had panicked and pulled out, causing you to miss the single best week of that period, your portfolio would be worth just $8,600. Just missing out on five days would cost you 20% of the potential growth.

The market goes way up, way down, and everything in between. Being reactive to bad news and scary headlines means you’re not allowing compounding to do its job; jumping in and out of the market based on emotion means you’re constantly resetting the clock.

The market’s best days, weeks, and months come when things have been bad, in the midst of a downturn. Missing those crucial periods has a terrible impact on our long-term rate of return. Stay committed even when things are tough.

Enough is Enough

And here’s a bonus, wealthy people know when they have enough. Check out my video on that.

Never miss an upload by subscribing to the channel and clicking the bell, so you get all of my notifications.

I also do a weekly podcast, Ready for Retirement with James Conole, where we talk tips and strategies that will help you create a better retirement.

And I’d love to connect on Instagram, Facebook, and LinkedIn.

And if you need additional help with your retirement plan or other financial planning needs, learn more about my firm and reach out to us here.