Planning for a comfortable retirement requires careful consideration of various factors, and one commonly discussed approach is the 4% rule. While this rule provides a good starting point, it’s essential to understand its nuances and explore additional strategies to make the most out of your retirement savings. Today we’re discussing the foundations of the 4% rule and highlighting practical ways to apply it in real-world scenarios, ensuring a secure and fulfilling retirement.

The Basis of the 4% Rule:

The 4% rule was developed through extensive research conducted by financial advisor Bill Bengen. His goal was to determine a sustainable withdrawal rate that would enable retirees to weather both favorable and unfavorable market conditions for a period of at least 30 years. Bengen found that withdrawing 4% of the initial portfolio value, adjusted for inflation annually, proved to be a viable strategy in various market environments.

Considering the Details:

It’s crucial to recognize the limitations of the 4% rule and adapt it to your specific situation. Here are some key considerations to keep in mind:

- Adjusting Withdrawals: Bengen’s research assumed a once-a-year withdrawal of the entire 4% on January 1st. However, most retirees prefer regular monthly or quarterly withdrawals. As you implement the rule, it’s essential to align the research findings with your preferred withdrawal frequency.

- Exploring Different Withdrawal Rates: Bengen examined withdrawal rates beyond 4% to determine sustainability in different market conditions. While 4% remained the highest withdrawal rate that ensured a 30-year portfolio lifespan, there were instances where higher rates, such as 5% or 6%, could have been sustained. To maximize your retirement income, consider dynamic adjustments based on the current market environment.

- Diversifying Your Portfolio: Bengen’s research focused on a portfolio split evenly between large US stocks and intermediate-term US treasuries. However, most individuals have portfolios with broader diversification, including small companies, international stocks, or emerging markets. Adding these elements to your portfolio might allow for higher withdrawal rates while maintaining sustainability over a longer retirement period.

Beyond the 4% Rule:

Bengen’s research provided a valuable starting point, but it lacked certain dynamic elements that could optimize retirement income. By considering additional strategies, you can enhance your financial outlook. Here are two essential factors to explore:

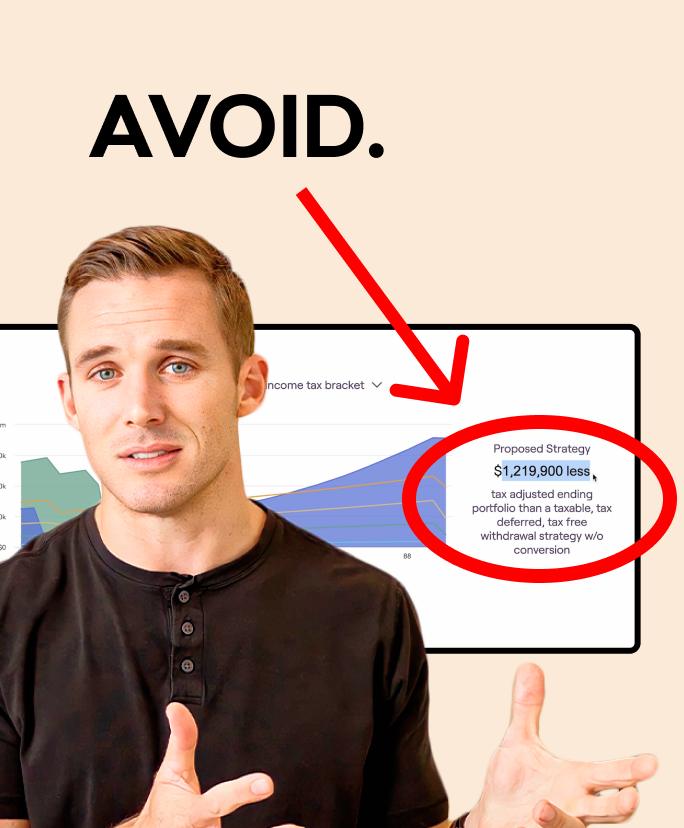

- Implementing Dynamic Adjustments: Bengen’s research didn’t incorporate ongoing adjustments to withdrawal rates. However, by actively managing your portfolio and applying decision frameworks, you can respond to market conditions. This might involve granting yourself periodic raises during favorable market environments or temporarily reducing spending during periods of market decline.

- Setting Guardrails for Withdrawals: Bengen’s original research solely focused on adjusting withdrawals for inflation over a 30-year period. However, establishing guardrails at specific intervals (e.g., three, five, or ten years into retirement) can help you proactively assess your financial standing. Adjustments can be made based on market performance, allowing for greater flexibility in spending and potentially increasing your retirement income.

Illustrating the Importance:

To highlight the impact of timing on retirement outcomes, consider two individuals with identical portfolios but different retirement dates. The person who retired just before a market downturn would have a significantly higher initial withdrawal amount than someone who retired during or after the downturn. This discrepancy demonstrates the limitations of a static 4% rule and underscores the need for a more adaptive approach.

The 4% rule is a good starting point, but you should understand its foundations and explore additional strategies to maximize your retirement income. By considering factors such as withdrawal adjustments, diversification, dynamic adjustments, and guardrails for withdrawals, you can enhance your financial outlook and ensure a secure and fulfilling retirement.

Need help with your retirement?

Work directly with a licensed financial advisor at Root. Book a no-obligation initial call now so we can show you how we’ve helped hundreds of people just like you build a retirement they love.