As individuals reach a certain age, the IRS mandates the distribution of funds from pre-tax retirement accounts. These required minimum distributions (RMDs) can push individuals into higher tax brackets, resulting in unnecessary tax payments. However, with proper planning, it is possible to minimize the impact of RMDs and save a significant amount of money in taxes. Today we explore seven strategies that can help you reduce your required minimum distributions and optimize your tax situation.

There are two important things to first understand before we can answer the question of how to reduce your RMDs.The first thing to understand is that not everybody’s goal should be to reduce RMDs. Your RMD is only an issue if its going to force you to take more out of your traditional IRA or pre-tax accounts than you otherwise would.

The second thing to understand is: what’s your actual goal with this money? Think 20 years into your retirement. Looking back, what would make you feel like it was a successful retirement?

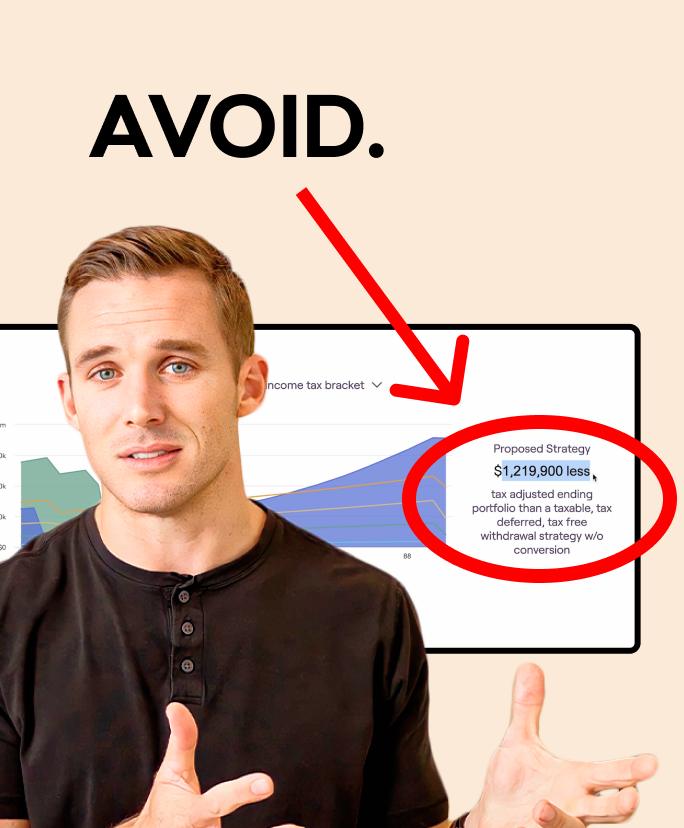

Roth Conversions:

One effective strategy is to consider Roth conversions. By converting funds from your traditional IRA to a Roth IRA, you can pay taxes at a potentially lower rate now, thereby reducing future tax liabilities. Roth conversions take advantage of the lower tax brackets that often accompany retirement, offering a tax planning window to optimize your finances.

Delay Social Security Benefits:

Delaying the collection of Social Security benefits until age 70 can extend your tax planning window. This delay allows for more significant tax efficiency during the early years of retirement, creating opportunities for additional Roth conversions and minimizing future RMDs.

Qualified Charitable Distributions (QCD):

A QCD allows you to donate funds directly from your IRA to a qualifying charity, bypassing taxable income. This strategy helps reduce your taxable income, lowers your RMD amount, and allows you to support charitable causes simultaneously. By utilizing a QCD, you can maximize the impact of your charitable giving while optimizing your tax situation.

Continue Working:

If you enjoy working and are employed beyond the age of 73, you may be able to delay taking distributions from your 401(k) if you do not own more than 5% of the company. This approach can temporarily reduce the impact of RMDs, providing you with more flexibility and potentially lower tax obligations.

Utilize Joint Life Expectancy Tables:

If you are married and your spouse is at least 10 years younger, you can take advantage of the joint life expectancy tables provided by the IRS. These tables allow for lower RMD percentages, reducing the required distributions from your retirement accounts.

Optimize Asset Location:

Strategic asset location can have a significant impact on your RMDs. By allocating assets differently across your various accounts (traditional IRA, Roth IRA, brokerage account), you can manage growth rates and tax implications. For example, consider holding more conservative investments in your traditional IRA, reducing its growth potential and subsequently lowering future RMDs.

Plan for Tax Implications on Heirs:

If you have a significant IRA balance, it is crucial to consider the tax impact on your heirs. Inheritors of large IRAs must distribute the funds within ten years, potentially subjecting them to high tax bills. Exploring options such as naming a charitable trust as a beneficiary can help mitigate the tax burden on your heirs while supporting charitable causes.

Reducing required minimum distributions and optimizing your tax situation requires careful planning and consideration of various strategies. While minimizing tax liabilities is important, it should not overshadow the overall goal of a fulfilling retirement. Always ensure that your tax strategy aligns with your life plan and financial objectives. By implementing the strategies outlined in this blog post and working with a financial planner, you can reduce the impact of RMDs and maximize the value of your retirement savings.

Need help with your retirement?

Work directly with a licensed financial advisor at Root. Book a no-obligation initial call now so we can show you how we’ve helped hundreds of people just like you build a retirement they love.