As retirement approaches, one crucial aspect to consider is what to do with your hard-earned 401k savings. This decision requires careful thought and planning, as it can significantly impact your financial well-being in the long run. In this post, we will delve into the various options available to you, enabling you to make an informed choice that aligns with your unique circumstances and goals. Let’s explore the key considerations to get the most out of your 401k plan.

Analyzing Costs:

The first step is to evaluate the costs associated with your 401k plan. While fees have decreased over the years, it is essential to understand the total expenses, including administration fees, record-keeping fees, and internal costs of the funds. Compare these costs to the expenses you would incur by doing a tax-free rollover into a traditional or Roth IRA. If your 401k offers expensive investment options, it might be more beneficial to consider transferring the funds to an IRA that provides you with greater control over investment choices and potentially lower costs.

Assessing Control and Ease of Use:

Consider the level of control you have over your 401k plan. Some plans may have limited flexibility, requiring paperwork or complex online processes for simple transactions like rebalancing, conversions, or withdrawals. The ease of managing your funds and implementing necessary changes is vital for effective financial management. Traditional and Roth IRAs generally offer greater control and ease of use, allowing you to make adjustments and strategic decisions with ease. Evaluate the convenience and user-friendliness of both options before making a decision.

Examining Investment Options:

Evaluate the investment options available in your 401k plan compared to those offered by IRAs. While 401ks may provide diversified investment options, they are often restricted to a predefined list of funds chosen by your employer. In contrast, IRAs offer a broader range of choices, including stocks, ETFs, and mutual funds. Assess whether your 401k provides suitable investment options that align with your desired portfolio allocation and risk tolerance. If you seek more flexibility and personalized investment decisions, an IRA might be the better choice.

Consolidation for Simplicity:

Consider consolidating multiple 401k accounts, if applicable, to streamline your retirement portfolio. Accumulating multiple accounts from previous employers can make it challenging to manage and coordinate your investments effectively. By consolidating your accounts into a single IRA or your current employer’s 401k, you gain a clearer picture of your overall portfolio and make strategic decisions based on a unified view. Consolidation simplifies tracking balances, assessing allocations, and implementing tax-efficient strategies.

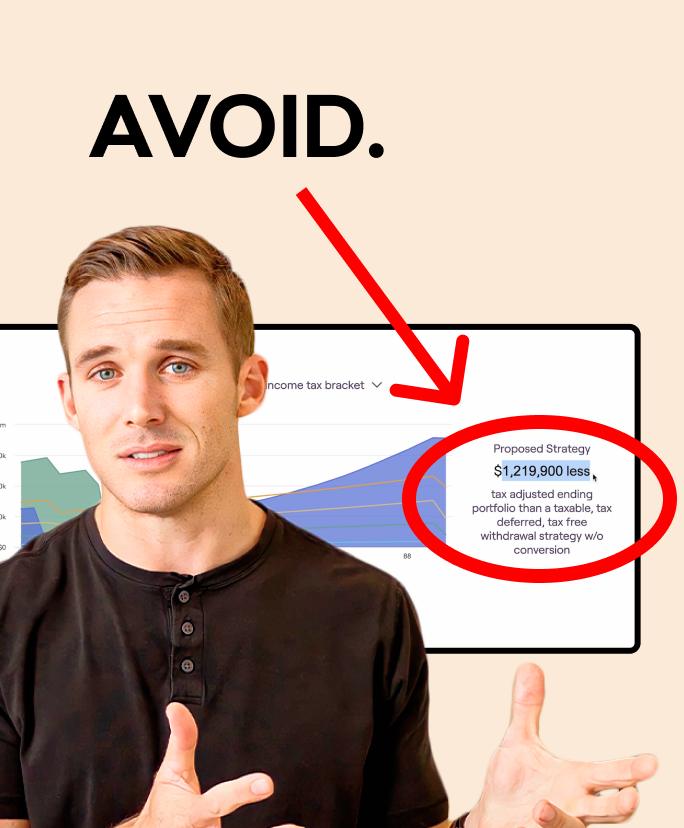

Coordinating Withdrawal Strategies:

Think about the coordination aspect when it comes to retirement account withdrawals. Different accounts, such as a 401k, a traditional IRA, and a Roth IRA, may have varying tax implications. By consolidating your retirement funds into a single account or custodian, you can more effectively manage your overall asset allocation and optimize your withdrawal strategy. Coordinating your withdrawals becomes more straightforward when your accounts are consolidated, allowing you to efficiently meet your income needs during retirement.

Important Considerations:

In addition to the aforementioned factors, several other key considerations require your attention. Firstly, if you have made after-tax contributions to your 401k, understand the tax implications of rolling over those funds to a traditional or Roth IRA. This distinction can impact the tax treatment of your contributions and subsequent growth. Secondly, if you hold company stock within your 401k plan, explore the concept of net unrealized appreciation, which can offer potential tax advantages for distributions. Lastly, be aware that if you retire in the year you turn 55 or older, you may be eligible for penalty-free distributions from your 401k, providing you with added flexibility and options.

When it comes to managing your 401k upon retirement, a range of options exists, each with its own advantages and considerations. By carefully examining costs, control, investment options, consolidation opportunities, ease of use, and coordination possibilities, you can determine the approach that best aligns with your financial goals. Remember to assess any unique circumstances, such as after-tax contributions or company stock holdings, to make fully informed decisions. Seek professional guidance from a financial advisor to tailor your choices to your specific situation and maximize the potential of your retirement nest egg.

Need help with your retirement?

Work directly with a licensed financial advisor at Root. Book a no-obligation initial call now so we can show you how we’ve helped hundreds of people just like you build a retirement they love.