Are you a single woman worried about your retirement? You’re not alone. Single women face unique challenges when it comes to planning and preparing for their retirement. In today’s blog post, we will explore some common mistakes people make when approaching retirement as a single individual and share a real client case study to help you understand how to address these challenges and create a retirement plan that suits your unique needs.

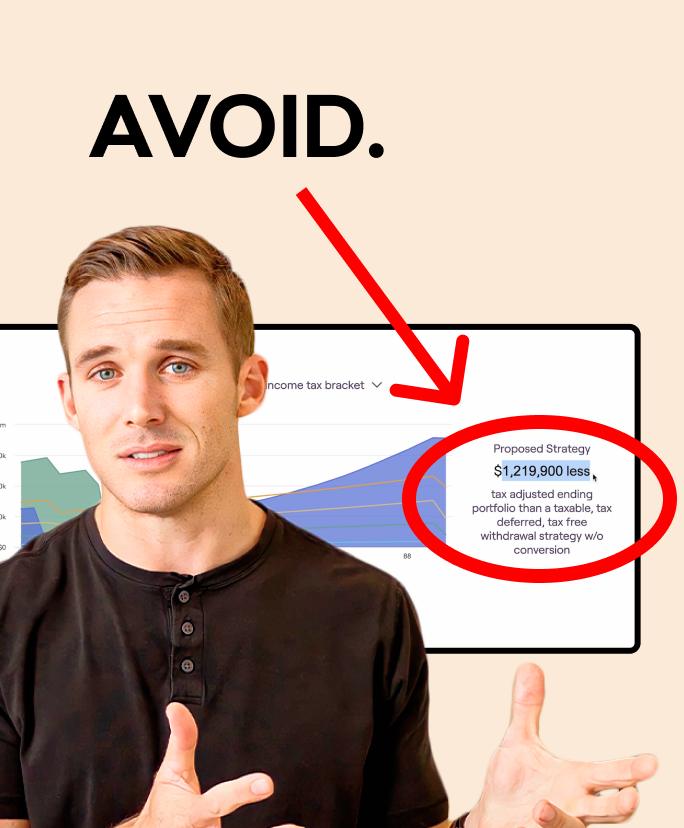

Common Mistakes to Avoid:

Before delving into the case study, it’s crucial to address some common misconceptions and mistakes that people often make when planning for retirement as a single person:

- Dividing Expenses in Half: Many assume that if they’re single, they can simply cut their expenses in half compared to when they were married. While some costs may decrease, such as food and entertainment, others, like property taxes, utilities, and mortgage or rent, remain unchanged.

- Tax Implications: Single individuals have a different tax situation than married couples. The standard deduction is lower, and social security benefits are calculated differently. These factors can significantly impact your retirement income.

- Shift in Objectives: Your retirement objectives may differ when you’re single. Married couples often focus on protecting both spouses throughout retirement, while singles prioritize their own lifetime and objectives.

Beth’s Case Study:

Now, let’s dive into the case study of Beth, a 63-year-old single woman who recently went through a divorce. Beth’s situation sheds light on how a change in marital status can impact retirement planning.

- Assessing Beth’s Goals:

- Beth’s initial plan was to stay in Southern California, travel, and visit her children and grandchildren in Tennessee.

- Post-divorce, her priorities shifted towards spending more time with her family.

- Evaluating Beth’s Resources:

- Beth had approximately $1.3 million in liquid assets and $1.45 million in home equity.

- Her income sources included her current salary and projected Social Security benefits.

- Analyzing Expenses and Goals:

- Beth’s desired annual retirement expenses were around $72,000, including healthcare, travel, and college savings for her grandchildren.

- She also wanted to budget for a new car every seven years.

Challenges and Solutions:

Initially, Beth’s retirement plan showed that she might run out of money by her early 80s. However, her financial advisor proposed a different approach:

- Unlocking Home Equity:

- Beth considered selling her California home, downsizing in Tennessee, and using the proceeds to buy a new home.

- This strategy increased her liquidity and reduced property taxes, state taxes, and her overall cost of living.

- Adjusting Contributions:

- Beth redirected her Roth IRA contributions into her 401(k) to take advantage of pre-tax deductions.

- Social Security Strategies:

- Beth explored spousal and survivor benefits based on her previous marriage, increasing her income floor.

- Investment Allocation:

- With her reduced expenses, Beth adjusted her investment portfolio to align with her new retirement goals.

Beth’s case study illustrates the importance of reassessing your retirement plan when transitioning from marriage to singlehood. By understanding your unique financial situation and objectives, you can make informed decisions that optimize your retirement lifestyle.

Remember that every individual’s retirement journey is unique, and it’s essential to seek guidance from a financial advisor who can tailor a plan to your specific needs. Retirement as a single woman can be fulfilling and secure when approached with careful consideration and expert guidance.

Need help with your retirement?

Work directly with a licensed financial advisor at Root. Book a no-obligation initial call now so we can show you how we’ve helped hundreds of people just like you build a retirement they love.