Understanding the tangible impact and the critical factors of Roth conversions is essential. In this comprehensive guide, James walks us through a client case study to demonstrate how Roth conversions can significantly impact your retirement savings. But is Roth conversion right for you? James considers five critical factors, looking at the case study of David (58) and Lisa (57), who have a substantial net worth, primarily in pre-tax accounts.

Understand Your Current Tax Rate:

The first critical factor is to recognize that the less you have in pre-tax accounts, the less impactful a Roth conversion will typically be. Understanding your asset composition is crucial in assessing the potential benefits of a Roth conversion.

Goals and Retirement Timeline:

David and Lisa plan to retire at 62, a pivotal factor in Roth conversion analysis. The period between retirement and the start of required distributions creates a tax planning window, allowing for strategic conversions. The couple aims to spend $10,000 per month in retirement, adjusting for inflation.

Income Sources and Savings:

Examining their income sources reveals David’s $195,000 salary and Lisa’s $50,000 income. Social security benefits and their saving strategies, including 401(k) contributions and IRA max-outs, contribute to their financial landscape. The assumption of an 8.7% pre-retirement and 6.5% post-retirement rate of return guides their investment strategy.

Understanding Cash Flows:

James illustrates the couple’s income sources, emphasizing a transition from high pre-retirement income to reliance on social security during retirement. This highlights the importance of strategic planning during the tax planning window to minimize tax burdens in retirement.

Tax Planning Window and Roth Conversions:

The tax planning window is a crucial concept where strategic Roth conversions can be executed. James introduces a scenario where David and Lisa live off their taxable account, maintaining a 0% effective tax rate during the initial years of retirement.

Analyzing Tax Brackets and Required Minimum Distributions (RMDs):

A deep dive into tax brackets illustrates the potential tax savings during the tax planning window. By strategically converting to fill lower tax brackets, the couple can significantly reduce their future tax liabilities, especially considering the impact of RMDs.

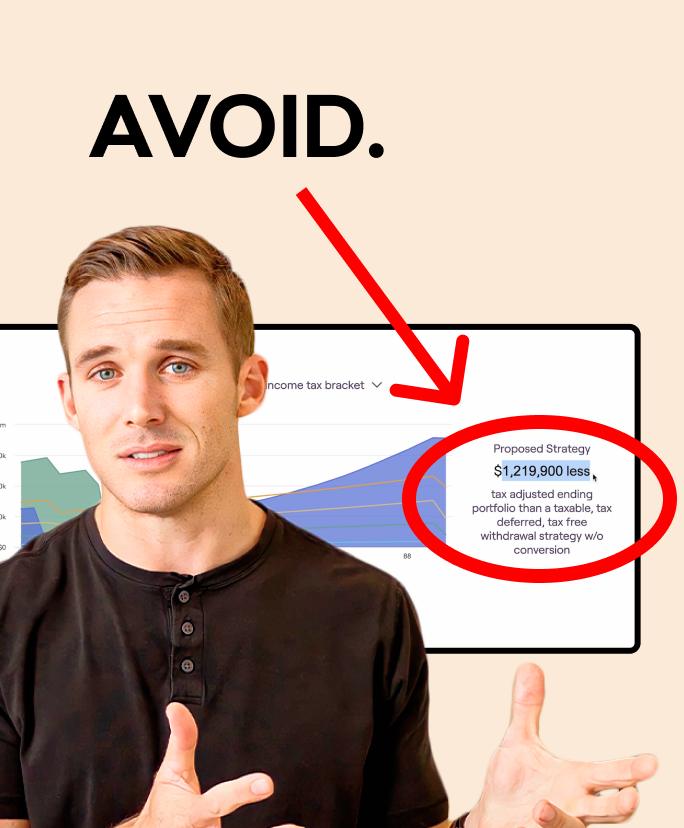

Optimizing Conversion Strategies:

James outlines the iterative process of finding the optimal conversion amount. Demonstrating different scenarios, he emphasizes the importance of balance, as over-converting may lead to unintended consequences. A well-thought-out conversion strategy can result in substantial tax savings.

Roth conversions present a powerful tool to maximize your retirement savings, but a thorough understanding of your unique financial situation is crucial. By following the five critical factors outlined above, you can make informed decisions to secure a financially sound retirement. Before diving into Roth conversions, consider consulting with a financial advisor to tailor the strategy to your specific needs and goals.

Need help with your retirement?

Work directly with a licensed financial advisor at Root. Book a no-obligation initial call now so we can show you how we’ve helped hundreds of people just like you build a retirement they love.